What is OTC Trading? Meaning, Types, Risks & How It Works

If you’ve ever heard about big-ticket deals happening “off the exchange”, that’s usually OTC trading. Unlike regular trading on NSE or BSE, OTC trades happen directly between two parties, often through a dealer network, without using a centralised exchange order book.

In this article, we’ll break down OTC trading in simple terms – what it is, how it works, where it’s used, and what risks you should be aware of as an investor or trader.

What Does OTC Mean?

OTC stands for Over-the-Counter.

In finance, OTC refers to trading of financial instruments directly between two parties, instead of on a formal stock exchange. These trades usually happen via a dealer network (brokers, dealers, investment banks) rather than on a public trading platform.

Examples of instruments that can be traded OTC:

-

Unlisted shares

-

Bonds

-

Certain derivatives (like swaps, forwards, OTC options)

-

Currencies (a large part of the forex market is OTC)

Because OTC trading happens outside a central exchange, prices, volumes and terms are not always publicly visible, which is very different from exchange-based trading.

How Does OTC Trading Work?

In OTC trading, there is no centralised order book like NSE or BSE:

-

Two parties agree to trade – this could be two institutions, a bank and a corporate, or a dealer and an investor.

-

A dealer/market maker quotes prices for buying and selling the instrument.

-

The trade is completed privately, often over electronic networks, phone, or proprietary platforms.

-

Terms like quantity, price, settlement date, and structure can be customised in many OTC products (especially derivatives and OTC options).

This flexibility is the biggest attraction of OTC markets – but it also creates more room for complexity and risk.

OTC Trading vs Exchange Trading

Here’s a simple comparison to understand the difference:

| Feature | Exchange Trading (NSE/BSE) | OTC Trading |

|---|---|---|

| Trading venue | Centralised exchange | Decentralised dealer network |

| Price transparency | High – live quotes visible to all | Lower – price often only known to parties trading |

| Standardisation | Contracts are standardised | Highly customisable terms |

| Regulation & oversight | Strong exchange & SEBI oversight | Less central oversight, more bilateral |

| Counterparty risk | Lower – clearing corporation stands in the middle | Higher – depends on the other party’s credit |

| Typical users | Retail + institutions | Mostly institutions, large corporates, HNIs |

Types of OTC Trading

OTC isn’t one single market – it’s a style of trading that exists across many instruments:

| Segment | OTC Example |

|---|---|

| Equity | Unlisted shares traded via OTCEI / dealers |

| Debt | Corporate bonds placed privately |

| Forex | Bank-to-bank or bank-to-corporate FX deals |

| Derivatives | Swaps, forwards, OTC options |

| Commodities | Bilateral commodity forwards or swaps |

In India, unlisted shares and some debt instruments are key examples of where OTC trading can appear.

What Are OTC Options?

You’ll often hear about OTC options in derivatives discussions.

OTC options are options contracts that are:

-

Traded privately between two parties (not on an exchange)

-

Customised in terms of strike price, expiry, notional, payoff structure, etc.

-

Often used by corporates or institutions to hedge very specific risks.

Unlike exchange-traded options:

-

There is no central clearinghouse in most OTC options trades.

-

Counterparty risk is higher.

-

There’s generally no secondary market – you can’t just “square off” as easily; you depend on your contract terms or renegotiation.

So, while OTC options are highly flexible, they are usually not meant for regular retail traders and fall more in the institutional or corporate hedging domain.

Advantages of OTC Trading

OTC trading offers some unique benefits, especially for large or sophisticated participants:

-

Customisation

-

Parties can design contracts that fit very specific needs (e.g., non-standard maturities, custom payoff structures).

-

-

Access to Unlisted or Special Instruments

-

Some securities are simply not listed on exchanges but can be traded OTC – especially unlisted stocks or bespoke derivatives.

-

-

Potentially Better Pricing for Large Blocks

-

Big deals can be negotiated privately without moving the visible market price too much.

-

-

Global Reach

-

Many cross-border FX, interest rate, and commodity deals are structured in OTC markets, offering a wide toolbox for risk management.

-

Risks and Drawbacks of OTC Trading

With the flexibility of OTC trading comes a set of serious risks that traders and investors cannot ignore:

-

Higher Counterparty Risk

-

Since there’s no central clearinghouse, you are directly exposed to the risk that the other party might default.

-

-

Lower Transparency

-

Prices and volumes are not always visible to the public. You may not know whether you’re getting the “best” price.

-

-

Lower Liquidity

-

For some OTC instruments, it can be hard to enter or exit positions quickly at a fair price.

-

-

Regulatory Risk

-

OTC markets tend to have less strict regulations compared to exchanges, which can increase the scope for mispricing or mis-selling if not handled carefully.

-

These risks are a big reason why, globally, regulators have pushed more derivatives trading from OTC into exchanges and clearing frameworks after the 2008 financial crisis.

OTC Trading in India: What Retail Investors Should Know

In the Indian context:

-

The term OTC trading is sometimes used when talking about

-

Unlisted shares

-

Negotiated deals through brokers or dealer desks

-

Older platform references like the Over-the-Counter Exchange of India (OTCEI).

-

-

Practically, most Indian retail investors don’t directly participate in large OTC derivative or bond markets – those are mostly used by banks, NBFCs, large corporates, and institutions.

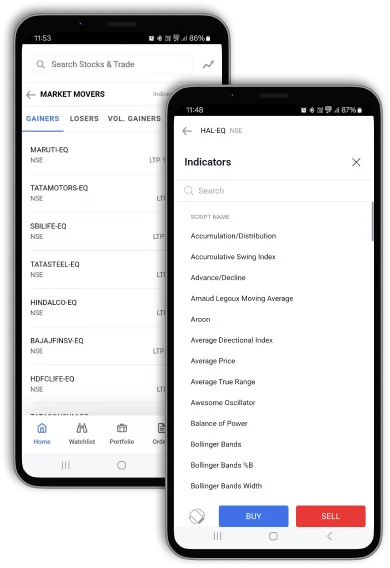

If you are a retail trader in India, your primary playground remains:

-

Exchange-traded equities

-

Exchange-traded F&O on NSE/BSE

-

Mutual funds, ETFs, and other regulated products

OTC-style products are more advanced and involve risk levels that typically don’t suit beginners.

Should You Consider OTC Trading as a Retail Trader?

For most new or intermediate traders, the answer is: probably not directly.

OTC trading is:

-

Less transparent

-

Less regulated (in many cases)

-

More complex in terms of contract structure

That said, you do get indirect exposure to OTC markets when:

-

You invest in mutual funds or bond funds that buy OTC debt.

-

You invest in banks or financial institutions that actively use OTC derivatives to hedge their own risks.

As a retail investor, your main focus should be:

-

Understanding listed products well

-

Managing risk

-

Using a stable, regulated platform like TradeSmart for exchange-based trading, instead of chasing opaque OTC deals.

FAQs on OTC Trading

1. What is OTC trading in simple words?

OTC trading means buying or selling financial instruments directly between two parties, without using a central stock exchange. A dealer or broker usually connects the two sides.

2. Is OTC trading safer than exchange trading?

Generally, no. Exchange trading is more transparent and tightly regulated. OTC trading carries higher counterparty and transparency risk.

3. Do Indian retail traders use OTC trading?

Most Indian retail traders primarily trade on exchanges like NSE and BSE. Direct participation in OTC markets is limited and more suited to institutions and large corporates.

4. What are OTC options?

OTC options are privately negotiated option contracts between two parties. Their terms (strike, expiry, payoff) can be customised, but they lack central clearing and an active secondary market.

5. What is the difference between OTC and exchange markets?

Exchange markets are centralised, transparent, and regulated. OTC markets are decentralised, customisable, and often less transparent, with higher counterparty risk.

Conclusion: Focus on Transparency, Not Just Flexibility

OTC trading plays a crucial role in global finance, especially for institutions that need flexibility and customised risk management solutions. But with that flexibility comes complexity, lower transparency, and higher counterparty risk.

For most individual traders and investors, building a solid foundation with exchange-traded products on regulated platforms is far more important than trying to access exotic OTC structures.

If you’re serious about growing in the markets, start with what you can see, understand, and control. Use a stable, low-cost, and transparent broker, learn the basics of risk management, and let products like mutual funds and banks handle the complex side of OTC exposures for you in the background.

Trade Smart, Stay Safe with TradeSmart

As more investors enter the stock market, choosing a safe and SEBI-regulated trading platform is more important than ever. At TradeSmart, we strongly encourage trading only through authorized exchanges like NSE and BSE, where transparency and investor protection are built in. Informal or unauthorised OTC trading in stocks and tips can be illegal, unregulated, and highly risky, often exposing investors to losses with little or no legal protection. If you’re serious about long-term wealth creation, avoid shortcuts and trade the right way. Open your Demat account with TradeSmart and get access to a reliable trading platform, stable execution, and flat ₹15 brokerage per order

Disclaimer

This article is for informational and educational purposes only. It is not investment, legal, or tax advice, nor is it a recommendation to buy or sell any financial product. Financial markets, including OTC markets, involve risk. Please consult a qualified financial advisor before making investment or trading decisions.