Excelsoft Technologies IPO – An Overview and Company Insight

The Excelsoft Technologies IPO GMP is already gaining attention as this Mysuru-based SaaS company — focused on digital learning and assessment solutions for global clients — heads to the public market. Excelsoft Technologies Limited provides cloud-based platforms for high-stakes assessments, digital learning, student-success systems and content services, operating across more than 60 countries. With offerings such as proctoring, learning management systems and assessment technologies, it addresses a niche yet fast-growing vertical within EdTech and enterprise SaaS.

The IPO is structured as a combination of a fresh issue and an Offer for Sale (OFS). The fresh issue proceeds will be used for capex (new building, upgrade of existing facility) and IT infrastructure enhancement, while the OFS allows promoters and early investors to monetise a portion of their stake. Considering Excelsoft’s steady financial turnaround, global client base and niche positioning, this IPO is poised to attract both growth-oriented and listing-gain investors.

Excelsoft Technologies IPO – Grey Market Premium (GMP)

Early indications show that the Excelsoft Technologies IPO GMP is modest but positive. With the price band set between ₹ 114 and ₹ 120 per share, grey market chatter suggests a premium of around ₹ 10-15 per share, implying potential listing gains of about 8-12%, subject to subscription strength and market sentiment.

| Metric | Estimate / Observation |

|---|---|

| Approximate GMP | ~ ₹ 10-15 above upper price band |

| Upper Price Band | ₹ 120 per share |

| Implied Listing Price | ~ ₹ 130-₹ 135 per share |

| Potential Listing Gain (%) | ~ 8-12% |

| Key Sentiment Drivers | Global SaaS exposure, niche vertical, profitability turnaround |

| Key Risks | Customer concentration, tech sector volatility, higher valuation |

Excelsoft Technologies IPO GMP

| Date | IPO GMP | GMP Trend | Gain |

| Today | ₹16 | 13.33% | |

| 17 Nov | ₹20 | 16.66% |

Pricing Details and Lot Size – Excelsoft Technologies IPO

-

Price Band: ₹ 114 to ₹ 120 per equity share (face value ₹ 10)

-

Minimum Lot Size: 125 shares per lot

-

Minimum Retail Investment: At upper band (₹ 120) → 125 × ₹ 120 = ~ ₹ 15,000

-

Issue Composition: Fresh Issue ~ ₹ 180 crore, OFS ~ ₹ 320 crore; Total issue size ~ ₹ 500 crore

-

Allocation Structure: Typically QIBs ~50% of net-offer, NiIs ~15%, Retail ~35% (subject to final document)

| Parameter | Detail |

|---|---|

| Price Band | ₹ 114 – ₹ 120 per share |

| Face Value | ₹ 10 per share |

| Lot Size | 125 shares |

| Minimum Retail Investment | ~ ₹ 15,000 |

| Fresh Issue Size | ~ ₹ 180 crore |

| OFS Size | ~ ₹ 320 crore |

| Total Issue Size | ~ ₹ 500 crore |

IPO Timelines at a Glance – Excelsoft Technologies IPO

| Event | Date |

|---|---|

| IPO Opens | 19 November 2025 |

| IPO Closes | 21 November 2025 |

| Basis of Allotment Finalised | ~ 24 November 2025 |

| Shares Credited / Refunds | ~ 25 November 2025 |

| Listing Date | 26 November 2025 |

How To Check the Allotment Status of the Excelsoft Technologies IPO

Once the allotment is finalised (around 24 November 2025):

-

Visit the Registrar’s website, select Excelsoft Technologies Ltd, and use your PAN / Application Number / Demat Account ID to view allotment status.

-

Alternatively, on NSE/BSE websites under IPO Allotment Status, select the issue name and input the necessary details.

Ensure you have your PAN, application number and demat account details for smooth access.

Book-running Lead Managers and Registrar – Excelsoft Technologies IPO

-

Book-Running Lead Managers (BRLMs): Anand Rathi Advisors Ltd.

-

Registrar: MUFG Intime India Pvt. Ltd.

Offer for Sale and IPO Size Breakdown – Excelsoft Technologies IPO

-

Total Issue Size: ~ ₹ 500 crore

-

Fresh Issue Component: ~ ₹ 180 crore – proceeds to the company for growth

-

OFS Component: ~ ₹ 320 crore – shares sold by promoters / existing shareholders

This structure means the company gains new capital while also providing liquidity to existing stakeholders.

Utilisation of Fresh Issuance and Technological Advancements – Excelsoft Technologies IPO

The fresh issue proceeds will be utilised for:

-

Purchase of land and construction of new building at Mysuru facility (~ ₹ 62 crore)

-

Upgradation of electrical systems and infrastructure at existing facility (~ ₹ 39.5 crore)

-

Upgrading IT infrastructure including software, hardware and communications (~ ₹ 54.6 crore)

-

The balance for general corporate purposes

From a technology standpoint, Excelsoft is focusing on its vertical SaaS solutions, assessment & proctoring platforms, and geographic/global scale. The capex is aimed at strengthening its delivery infrastructure and positioning for growth in the global education-tech and certification market.

IPO Financial Information

In the fiscal year ended March 31, 2025, Excelsoft Technologies reported revenue of ₹ 233.29 crore and a profit after tax of ₹ 34.69 crore. With a strong margin profile (EBITDA margin improved) and a turnaround in profitability, the company is positioned for growth. However, revenue growth has been moderate and customer concentration remains a risk.

| Fiscal Year Ending March | Revenue (₹ crore) | Profit After Tax (₹ crore) |

|---|---|---|

| FY 2024 | ~ ₹ 200 | ~ ₹ 12.8 |

| FY 2025 | ~ ₹ 233.3 | ~ ₹ 34.7 |

Conclusion

The Excelsoft Technologies IPO presents a compelling opportunity in the niche of vertical SaaS and global learning/assessment platforms. With Excelsoft Technologies IPO GMP signalling early optimism, a credible business model and growth infrastructure in place, medium-term investors may find value. That said, investors should be aware of risks — especially customer concentration, limited size compared to global peers, and execution as the company scales. For those convinced of the secular growth in EdTech and enterprise SaaS, this IPO merits strong consideration.

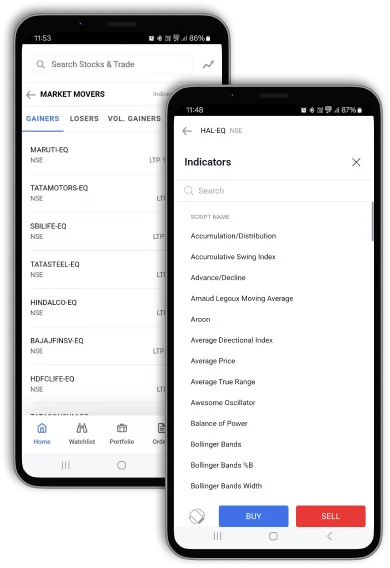

Investing in IPOs Made Simple

If you’re ready to apply for IPOs like Excelsoft Technologies, make sure you open a demat account in advance so you’re prepared when the window opens. With TradeSmart you get a stable trading platform, ₹15 per order brokerage, user-friendly interface and expert support—giving you a streamlined experience across IPOs and equity markets.

Disclaimer

This article is provided for informational purposes only and does not constitute investment advice or a recommendation to subscribe to the Excelsoft Technologies IPO. Investors should carefully read the Red Herring Prospectus (RHP), assess all risk factors, compare valuations with peer companies and consult a qualified financial advisor before investing. The Excelsoft Technologies IPO GMP estimate is indicative and subject to market fluctuations. TradeSmart and its associates are not liable for any financial loss arising from decisions made based on this content.