Nifty All Time High: What’s Fueling the Record Rally After 14 Months?

The Nifty All Time High moment has finally arrived after a long 14-month wait, reigniting optimism across Dalal Street. India’s benchmark index surged past its previous peak, marking a fresh record and signalling renewed confidence in domestic equities. This milestone has sparked a key question among investors — is this rally sustainable, or are we nearing overheated territory?

In this article, we break down why the Nifty hit an all-time high, what factors aligned in its favour, the sectors that led the rally, potential risks ahead, and how investors can interpret this phase without getting carried away.

Why Is Nifty’s All-Time High So Important?

A fresh all-time high is more than just a number. It reflects collective market confidence in:

-

Corporate earnings growth

-

Economic stability

-

Policy continuity

-

Liquidity support

After 14 months of consolidation, corrections, and global uncertainty, the Nifty’s breakout suggests a shift from caution to conviction.

Key Snapshot: Nifty’s Record-Breaking Session

| Particulars | Details |

|---|---|

| Index | Nifty 50 |

| Fresh All-Time High | Above 26,277 levels |

| Time Taken | ~14 months |

| Market Breadth | Broad-based participation |

| Key Drivers | Banks, IT, Capital Goods, Auto |

What Triggered the Nifty All Time High?

1)Strong Corporate Earnings Momentum

Indian companies, especially in banking, infrastructure, and manufacturing, delivered consistent earnings growth. Stable margins and improving balance sheets reassured investors that growth is not just narrative-driven but backed by numbers.

Earnings growth has historically been the most reliable driver of sustained bull markets, and current performance aligns well with long-term averages.

2) Banking & Financial Stocks Leading the Charge

Heavyweights such as private banks and PSU banks played a crucial role. Improved asset quality, lower NPAs, healthy credit growth, and stable interest margins pushed banking stocks higher.

| Sector | Market Impact |

|---|---|

| Private Banks | Stability & index weight support |

| PSU Banks | Valuation rerating |

| NBFCs | Credit growth optimism |

3) Foreign Institutional Investors (FII) Are Back

After months of muted participation, FIIs returned as net buyers. Global investors found Indian markets attractive due to:

-

Strong GDP growth outlook

-

Political stability

-

Structural reforms

Historically, sustained FII inflows often coincide with index breakouts, lending durability to rallies.

4) Global Cues Turn Supportive

Easing inflation globally, stable interest rates, and optimism around major economies reduced risk aversion. Indian markets benefited indirectly as global capital looked for growth-oriented destinations.

5) Domestic Investors Provide a Stable Base

Unlike previous cycles, domestic mutual funds and SIP inflows continued steadily. This reduced downside volatility and ensured dips were quickly bought into.

Why This Rally Looks More Balanced Than Past Highs

One key difference this time is participation beyond just a handful of stocks. While large caps led initially, mid-caps and select small-caps also joined — though with moderation.

This reduces the risk of a narrow-market rally and increases sustainability.

Sectors That Benefited the Most

| Sector | Reason for Upside |

|---|---|

| Banking & Financials | Earnings visibility |

| IT | Valuations + global demand stability |

| Capital Goods | Capex cycle revival |

| Auto | Festive demand & rural recovery |

| FMCG | Margin stability |

What Risks Should Investors Be Aware Of?

Even as the Nifty All Time High creates excitement, risks should not be ignored:

-

Global geopolitical developments

-

Crude oil volatility

-

Unexpected inflation spikes

-

Valuation stretch in pockets of the market

Past data shows that markets often consolidate after hitting fresh highs, not necessarily fall sharply, but digestion phases are common.

Should Investors Be Worried at All-Time Highs?

Not necessarily. Markets hitting new highs is a sign of economic progress. However:

-

Fresh lump-sum investing requires caution

-

Asset allocation becomes more important

-

Long-term investors should stay disciplined

The biggest mistake investors make is either exiting too early due to fear or chasing momentum blindly.

What History Tells Us About Nifty at Record Highs

| Scenario | Typical Outcome |

|---|---|

| Strong earnings cycle | Continuation or consolidation |

| Weak earnings | Sharp corrections |

| Liquidity-driven rally | Volatility increases |

Currently, earnings visibility adds strength to the ongoing trend.

What Should Investors Do Now?

-

Stick to long-term goals

-

Continue SIPs instead of timing peaks

-

Focus on fundamentally strong companies

-

Avoid leveraged positions during euphoric phases

Big Picture Takeaway

The Nifty All Time High after 14 months is not a random event, it is backed by earnings, liquidity, and economic stability. While short-term volatility is natural near record levels, India’s structural growth story remains intact.

Conclusion

The latest Nifty All Time High marks a significant milestone for Indian equities. Rather than predicting immediate upside or downside, investors should view this phase as a reminder to stay disciplined, diversified, and aligned with long-term objectives. Markets reward patience far more than prediction.

Frequently Asked Questions (FAQs)

Q1. Why did Nifty hit an all-time high now?

Due to strong earnings, banking sector performance, FII inflows, and stable global cues.

Q2. Is it risky to invest when markets are at record highs?

Risk depends on strategy. SIP-based and long-term investing reduces timing risk.

Q3. Can Nifty fall immediately after an all-time high?

Short-term corrections are possible, but long-term direction depends on earnings and macro stability.

Q4. Which sectors supported this rally the most?

Banking, IT, capital goods, auto, and selective FMCG stocks.

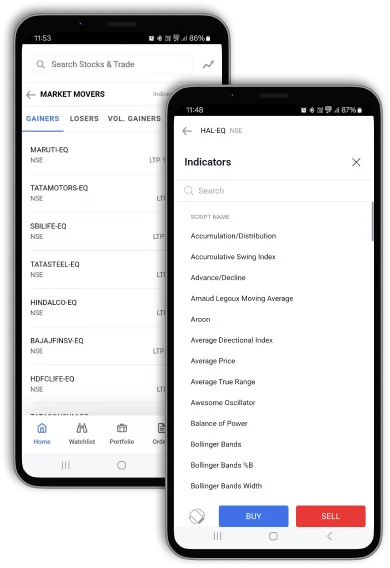

If you’re preparing to start investment, trading or planning to diversify your investment portfolio, now is a good time to get started.

👉 Open a Demat account with TradeSmart and stay ahead of the market with smart tools and low-cost trading.

⚠️ Disclaimer

This article is for informational purposes only and should not be construed as investment advice. Stock market investments are subject to market risks. Past performance is not indicative of future results. Readers are advised to consult their financial advisors before making any investment decisions. TradeSmart does not recommend or endorse any specific securities or strategies.